Note: This article has been adopted from an assignment I submitted for a post-graduate course. It is my own analysis based on information I could access and has not been endorsed by UEFA or any of the mentioned organisations.

Background

UEFA – the Union of European Football Associations – is the governing body of European football. It is an association of associations, a representative democracy, and is the umbrella organisation of 54 national football associations across Europe. UEFA is a unique organisation because it is listed as a not-for-profit, but at the same time it is focused on maximising revenue.

UEFA Business Strategy

UEFA’s strategy can simply be summarised as football. It seeks to deliver high quality football tournaments from which it is able to generate revenue mainly through the sale of broadcasting and sponsoring rights as well as ticket sales.

A lot goes into organising and delivering football tournaments and therefore critical strategic decisions have to be made in order to ensure stakeholder value. At UEFA technology is a key component in ensuring quality service delivery especially to broadcasters, UEFA’s main customers.

UEFA also aims to continuously develop the sport in Europe by assisting member countries develop the appropriate structures, systems and human capital. At the heart of UEFA’s strategy is coaching education, which seeks to develop footballers from a young age while providing training for future coaches. This leads to improved standards football (tournaments), UEFA’s main product.

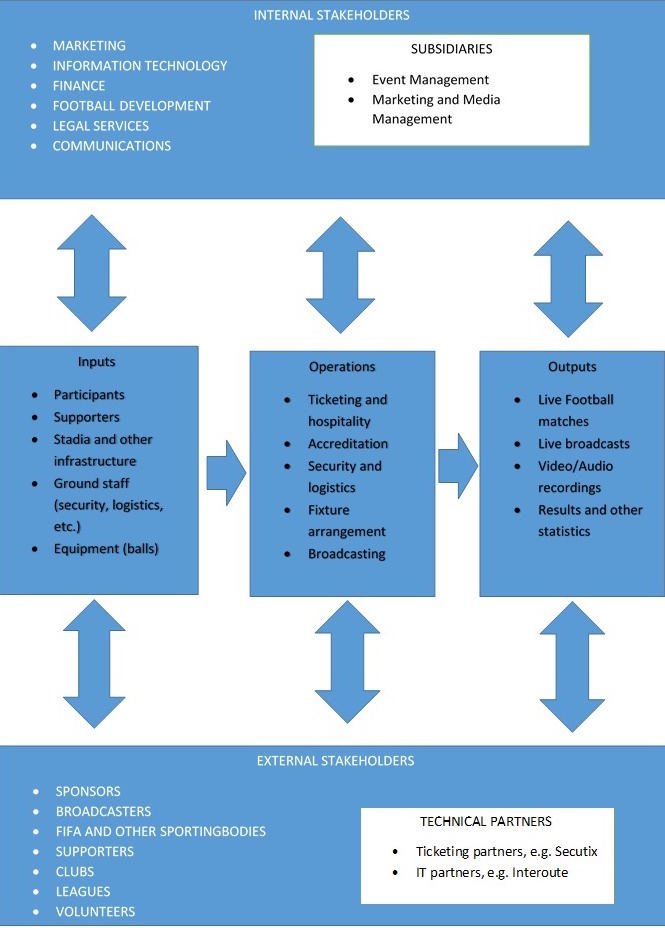

UEFA also seeks to bring together various stakeholders, including players, referees, supporters, football associations, sponsors, broadcasters, government (European Union) among others. In this analysis we look at what goes into the delivery of EUFA’s key product, football tournaments and their consumption. The diagram below provides an illustration:

Stakeholder Value

UEFA lists the following stakeholder groups on their website, UEFA.org. The are classified below into primary and secondary stakeholders:

- UEFA – UEFA itself and the 54 member associations under UEFA. The associations also responsible for the national teams that participate in UEFA’s international competitions.

- Clubs –Clubs are another group of primary stakeholders as they provide the teams that compete in UEFA’s competitions, for example, the UEFA Champions League

- Leagues – the body recognised and charged with running the national championship in UEFA member countries.

- Players – Players are the backbone of the UEFA’s activities and in some cases influence the decisions.

- Supporters – the ultimate consumers of EUFA’s products either through attendance at live matches or transmissions from the various broadcasters.

- European Union – provides the legal and political framework within which UEFA and member states operate.

- Similar sporting organisations – This is another secondary stakeholder group exercising a measure of influence on UEFA activities through shared expertise as they basically have similar stakeholder groups.

- Volunteers – key stakeholders especially during major tournaments. However, it is difficult to classify them as either primary or secondary stakeholders. This is because, without them the tournament would not be a success and at the same time they hold no real influence due to the nature of their engagement.

Stakeholder Expectations

The following table outlines the expectations of stakeholders listed above:

Products and Process

Be it through television or at live matches supporters seek to be entertained. This is the value they derive from football. Using the augmented product model (Payne and Holt, 2001), we can identify a football match as the generic product – all supporters want to watch is a football match (or tournament), broadcasters purchase (and sometimes resell) the rights to air matches.

For those who attend live matches the expected product includes safety and security at match venues, basic amenities such as washrooms, hospitality facilities such as restaurants and bars. Supporters expect a good experience from when the purchase the tickets, arrive at the match venue, watch the match and afterwards depart.

For those who watch television streams the expected product includes commentary, replays, statistics such as corner counts, pre-match/half-time/post-match analysis, etc.

The augmented product in the case of live matches could be other forms of entertainment before the match and or during the half-time break. According to a report by PwC titled, Changing the game – Outlook of the global sports market to 2015, “At root, people buy tickets to sports events and pay-tv services carrying exclusive sports content expecting to be entertained…Sport and entertainment events are increasingly being staged together, as a way to enhance the overall experience and extend the length of the events – and therefore the time that the supporters and viewers stay.”

In another publication by PwC, Football’s Digital Transformation – Growth opportunities for football clubs in the digital age, digital is seen to hold potential to attract and hold customers. Hence through applying digital strategies to product development, the potential product can be realised. A good example is the use social media to enhance fan engagement.

In assessing the processes I looked at one of key processes that UEFA uses to deliver value to its key stakeholders, supporters.

Ticketing

Taking Euro 2016 as a case study ticketing is done in windows. Tickets are allocated by lottery. The first window runs from May 12, 2015 to June 10, 2015 during which time supporters are able to register the official UEFA Ticket Portal. From June 10, 2015 to July 10, 2015, the second window, one million tickets will be available for sale on the portal, which remains open for registration during this period.

The third window (after the finals draw) runs from December 2015 to January 2016. During this period national team supporters of countries that have qualified are given a chance to purchase tickets to their teams’ matches. This is done in collaboration with the national associations. Also Follow My Team tickets are sold during this window.

The fourth window runs from March 2016 to April 2016. During this window supporters will be allowed to resell their ticket in the official Ticket Resale Portal at face value. This is a good move by UEFA since it removes the chances of a black market emerging for tickets. No tickets will be sold at match venues. This also allows for fair (transparent), safe and secure distribution of tickets for supporters around the world.

Technology

The technology behind the ticketing process, SecuTix 360, will be provided by SecuTix SA. This is a specialist solution, that provides ticketing and hospitality management. The system provides the flexibility, robustness and scalability required by the ticketing process. For example, the system will be able to cope with peak traffic during the sale windows. This is yet another good decision by UEFA as it would have to expensive and inefficient to run such a system in-house.

UEFA has embraced cloud computing in achieving its business strategy because UEFA’s core services such as ticketing, broadcasting and event logistics are technology intensive. Further there is an increase in demand for digitized content by digital consumers who now make up a majority of UEFA’s audience. In operationalising this strategy UEFA has outsourced part of its IT infrastructure to a private cloud company. This is another positive move by UEFA in cutting in improving service delivery by taking advantage of available technology.

Relevance of References

Social Media Strategy for online service brands by Adam J. Mills and Kirk Plangger (March 2015)

This journal article is relevant as it reflects a strategy currently being employed by UEFA and other sporting organisations. There is a move within football ranks to use social engagement for supporter engagement. Social media is being used by UEFA to disseminate content including photos and videos, and to facilitate interactions between fans. For example, UEFA used twitter extensively in the just concluded season (2014/2015) and this saw a great increase in the number of ‘followers’. This trend is set to continue next season and at the European Championships in 2016.

IT Risk Mitigation is Still a Work in Progress by Becky Patrida (March/April 2015)

This article is relevant to the operations at UEFA since IT underpins UEFA’s business strategy and it is constantly working with specialised IT companies to provide some of its core services such as ticketing. The article specifically points to importance of managing IT risks within supply chains. With the rise in cloud and mobile computing IT risk becomes even more relevant and UEFA should constantly assess the risks involved when making certain operational decisions.

Conclusion

UEFA operates in a complex environment often referred to as an ecosystem with a multitude of stakeholders. Its business strategy is obvious, football, but innovation is at the heart of its operations strategy to ensure they continue delivering value to its main stakeholders, the supporters. I believe other organisations charged with managing the sport are, can or should operate in a similar manner.

References

World Wide Web documents

- PricewaterhouseCoopers International Limited (2014) Football’s Digital Transformation. Growth opportunities for football clubs in the digital age [online], PricewaterhouseCoopers International Limited. Available from: https://www.pwc.se/sv_SE/se/media/assets/footballs-digital-transformation.pdf [ Accessed 9 June 2015]

- PricewaterhouseCoopers International Limited (2011) Changing the game. Outlook for the global sports market to 2015 [online], PricewaterhouseCoopers International Limited. Available from: https://www.pwc.com/en_GX/gx/hospitality-leisure/pdf/changing-the-game-outlook-for-the-global-sports-market-to-2015.pdf [Accessed 9 June 2015]

- Flinders K. (2012) Cloud computing underpins UEFA business strategy [online], Computer Weekly. Available from: http://www.computerweekly.com/news/2240159071/Cloud-computing-underpins-Uefa-business-strategy [Accessd 9 June 2015]

- Venkatraman A. (2013) UEFA considers BYOD policy for Euro 2016 [online], Computer Weekly. Available from: http://www.computerweekly.com/news/2240187056/Uefa-implements-BYOD-policy-for-Euro-2016 [ Accessed 9 June 2015]

- Mortleman J. (2014) UEFA changes the game with private cloud adoption [online], Global Intelligence for the CIO. Available from: http://www.i-cio.com/strategy/mobile/item/uefa-changes-the-game-with-private-cloud-adoption [Accessed9 June 2015]

Journal articles

- Mills J.A. and Plangger K. (2015) Social media strategy for online service brands, The Service Industries Journal, 35:10, 521 -536, DOI: 10.1080/02642069.2015.1043277

Partida B. (2015) IT Risk Mitigation is Still a Work in Progress, Supply Chain Management Review, vol. 19, Issue 2, March 1 2015, pp70-72. 3p

Reports

- Holt M. (2009), UEFA, Governance, and the Control of Club Competition in European Football, London, Birkbeck Sport Business Centre, no. 1

Appendix

For detailed background information on UEFA refer to http://uefa.org

Great work of investigation M.Brian, must be congratulated. UEFA is One of the richest organization in the world and Over this nice picture, we can’t neglect its status of MONEY and POWER.

Thank you Hakim. Indeed UEFA is one of the richest organisations and it would be great for other (sporting) organisations to learn from their business model.

That’s for sure my brother, this might be a model for successful business…you are on the good way to become the boss of a company of event organization. You had the process, now you have the idea 🙂